Marriott Bonvoy

Marriott Bonvoy (MB) is the loyalty program offered by Marriott International. You can earn points in different ways, like staying at Marriott hotels, using credit cards affiliated with Marriott, going on tours and activities, taking Uber rides, converting points from banking partners, and buying points directly. These points can be used to book hotel stays, flights, car rentals, enjoy experiences, get merchandise and gift cards, and even transfer to airline partners. Additionally, you have the opportunity to earn free night certificates as well.

-

Classic Luxury

The Ritz-Carlton

St. Regis Hotels & Resorts

JW Marriott Hotels

Distinctive Luxury:

Ritz-Carlton Reserve

The Luxury Collection

W Hotels

EDITION Hotels

Classic Premium:

Marriott Hotels & Resorts

Sheraton Hotels and Resorts

Marriott Vacation Club

Delta Hotels

Distinctive Premium:

Le Méridien

Westin Hotels

Renaissance Hotels

Gaylord Hotels

Classic Select:

Courtyard by Marriott

Four Points by Sheraton

SpringHill Suites

Protea Hotels by Marriott

Fairfield by Marriott

Distinctive Select:

AC Hotels by Marriott

Aloft Hotels

Moxy Hotels

Classic Longer Stays:

Marriott Executive Apartments

Residence Inn by Marriott

TownePlace Suites

Distinctive Longer Stays:

Element Hotels

Homes & Villas by Marriott International

Collections::

Autograph Collection

Design Hotels

Tribute Portfolio

-

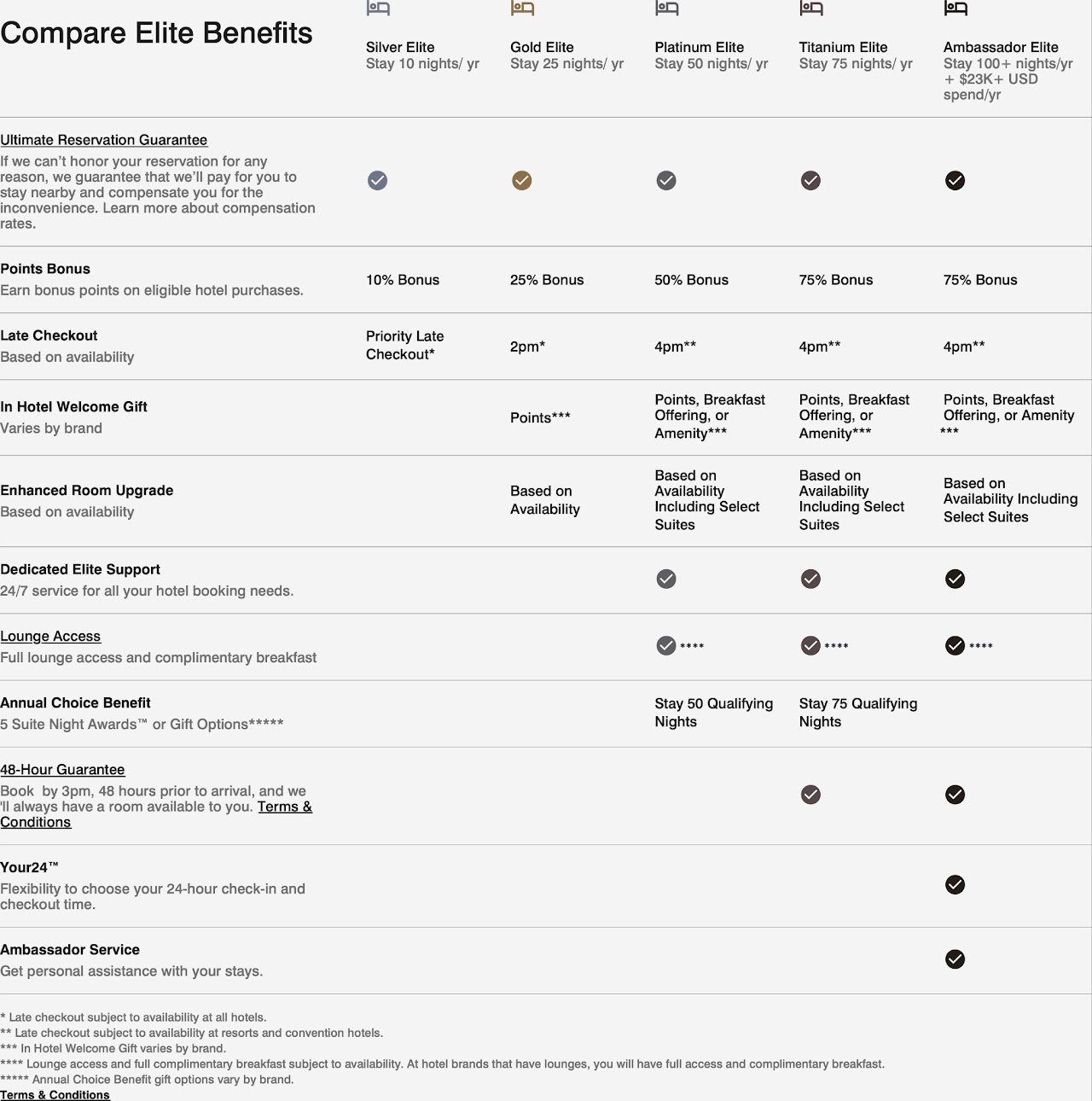

You can achieve different status levels by meeting the thresholds listed in the table below. By participating in activities with Marriott, you can earn the corresponding number of Elite Night Credits (ENC).

Earn 1 ENC for every 2 nights stayed at Protea Hotels by Marriott

Earn 1 ENC for every 3 nights stayed at Marriott Executive Apartments

Earn 1 ENC for every 1 night stayed at all other properties

Specific status levels can also be obtained by holding certain credit cards. However, having status automatically through credit cards does not mean you have stayed a certain number of nights (for example, having Gold status through a credit card does not mean you have 25 ENC).

Co-branded credit cards provide ENC. Each card, except for the Marriott Bonvoy Brilliant American Express (which provies up to 25 ENC), provides up to 15 ENC. You can receive a maximum of 15 ENC from any combination of cards, unless you have the Marriott Bonvoy Business American Express (US) along with another US-based MB card, which gives you a total of 30 ENC (or 40 if you also have the Marriott Bonvoy Brilliant American Express).

Moreover, you can receive MB Gold status for free if you have any of the following cards:

American Express (Can) The Platinum Card

American Express (Can) Business Platinum

American Express (US) The Platinum Card

American Express (US) Business Platinum

Status member benefits are illustrated in the table below.

-

Points can be earned in the following ways, some of which are further detailed below

Stays

10 points per $1 USD (base)

5 points per $1 USD (base) at Homes & Villas by Marriott International, Residence Inn by Marriott, TownePlace Suites, Element Hotels, and Protea Hotels by Marriott

2.5 points per $1 USD (base) at Marriott Executive Apartments

Credit cards

Uber

Conversion

Transfer

Buying

-

There are several co-branded credit cards that allow you to earn MB points directly. Most of these offerings are all US-domiciled so if you need help getting started in the US credit card game, check out our guide.

Unique among cards issued from several banks, there are restrictions around holding cards concurrently or receiving WB:

*Links for the cards are NOT affiliate links

-

To receive the WB:

You cannot have had the Chase The Ritz-Carlton Card (US) within the last 30 days.

You cannot have had the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), Chase Marriott Bonvoy Bountiful Card (US), or Chase The Ritz-Carlton Card (US) within the last 30 days.

You cannot have opened the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 90 days.

You cannot have received a WB on the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 24 months.

-

To receive the WB:

You cannot have had the Chase The Ritz-Carlton Card (US) within the last 30 days.

You cannot have had the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), Chase Marriott Bonvoy Bountiful Card (US), or Chase The Ritz-Carlton Card (US) within the last 30 days.

You cannot have opened the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 90 days.

You cannot have received a WB on the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 24 months.

-

To receive the WB:

You cannot have had the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), Chase Marriott Bonvoy Bountiful Card (US), or Chase The Ritz-Carlton Card (US) within the last 30 days.

You cannot have opened the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 90 days.

You cannot have received a WB on the Chase Marriott Bonvoy Bold Card (US), Chase Marriott Bonvoy Boundless Card (US), or Chase Marriott Bonvoy Bountiful Card (US) within the last 24 months.

-

You cannot concurrently hold the Chase Marriott Bonvoy Bold Card (US) and the Chase Marriott Bonvoy Boundless Card (US) or have received a WB within the last 24 months.

To receive the WB:

You cannot have had the Marriott Bonvoy American Express Card (US) within the last 30 days.

You cannot have opened the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 90 days.

You cannot have received a WB on the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 24 months.

-

You cannot concurrently hold the Chase Marriott Bonvoy Bold Card (US) and the Chase Marriott Bonvoy Boundless Card (US) or have received a WB within the last 24 months.

To receive the WB:

You cannot have had the Marriott Bonvoy American Express Card (US) within the last 30 days.

You cannot have opened the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 90 days.

You cannot have received a WB on the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 24 months.

-

To receive the WB:

You cannot have had the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 30 days.

You cannot have opened the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 90 days.

You cannot have received a WB on the Marriott Bonvoy Bevy American Express Card (US), Marriott Bonvoy Brilliant American Express Card (US), Marriott Bonvoy Business American Express Card (US), or Marriott Bonvoy American Express Card (US) within the last 24 months.

-

Annual fee: $120

WB: 55,000

MSR: $3,000

Complimentary MB Silver status

Upgrade to MB Gold status after spending $30,000 (membership year)

Up to 15 ENC (calendar year)

5X points at Marriott properties

Anniversary free night reward up to 35,000 points (membership year)

-

Annual fee: $150

WB: 85,000

MSR: $5,000

Upgrade to MB Gold status after spending $30,000 (membership year)

Up to 15 ENC (calendar year)

12X points at Hilton properties

Anniversary free night reward up to 35,000 points (membership year)

-

Annual fee: $650 USD

WB: 150,000

MSR: $6,000 USD

Complimentary MB Platinum status

Up to 25 ENC (calendar year)

6X points at Marriott properties

No FX

Anniversary free night reward up to 85,000 points (membership year)

Choice Award after spending $60,000 USD (calendar year)

Priority Pass Select membership with unlimited visits for cardholder plus 2 guests

$25 USD monthly dining statement credits

$100 USD The Ritz-Carlton/St. Regis credit (special rate)

-

Annual fee: $250 USD

WB: 125,000

MSR: $5,000 USD

Complimentary MB Gold status

Up to 15 ENC (calendar year)

6X points at Marriott properties

1,000 points per stay at Marriott

No FX

Free night reward up to 50,000 points after spending $15,000 USD (calendar year)

-

Annual fee: $125 USD

WB: 75,000

MSR: $3,000 USD

Complimentary MB Gold status

Up to 15 ENC (calendar year)

6X points at Marriott properties

No FX

Anniversary free night reward up to 35,000 points (membership year)

Additional free night reward after spending $60,000 USD (calendar year)

7% discount on Marriott standard room rate

-

Annual fee: $95 USD

WB: -

MSR: -

Complimentary MB Silver status

Upgrade to MB Gold status after spending $35,000 USD (calendar year)

Up to 15 ENC (calendar year)

6X points at Marriott properties

No FX

Anniversary free night reward up to 35,000 points (membership year)

-

Annual fee: $250 USD

WB: 85,000

MSR: $4,000 USD

Complimentary MB Gold status

Up to 15 ENC (calendar year)

6X points at Marriott properties

1,000 points per stay

No FX

Free night reward up to 50,000 points after spending $15,000 USD (calendar year)

-

Annual fee: $95 USD

WB: 75,000

MSR: $3,000 USD

Complimentary MB Silver status

Upgrade to MB Gold status after spending $35,000 USD (calendar year)

Up to 15 ENC (calendar year)

1 ENC per $5,000 USD

6X points at Marriott properties

No FX

Anniversary free night reward up to 35,000 points (membership year)

-

Annual fee: $0

WB: 50,000

MSR: $1,000 USD

Complimentary MB Silver status

Up to 15 ENC (calendar year)

3X points at Marriott properties

No FX

-

Annual fee: $450 USD

WB: 130,000

MSR: $3,000 USD

Complimentary MB Gold status

Up to 15 ENC (calendar year)

6X points at Marriott properties

No FX

Anniversary free night reward up to 85,000 points (membership year)

Priority Pass Select membership with unlimited visits for cardholder plus unlimited guests

$300 USD airline fee credit (calendar year)

*Card is no longer available for new applications. Possible to obtain card via downgrade/upgrade

-

Here are a few tips to consider when applying for the US MB cards:

It's generally recommended to apply for the Chase-issued cards first to work around the 5/24 restrictions.

If you plan on keeping the Chase Marriott Bonvoy Boundless Card (US) for its free night award, it's advisable to apply for the Chase Marriott Bonvoy Bold Card (US) first if you also want to receive that WB.

Similarly, if you plan on keeping the Chase The Ritz-Carlton Card (US) for its free night award, you should apply for the Marriott Bonvoy Brilliant American Express Card (US) first if you want that card.

-

You can earn MB points by converting Amex MR points at the following ratios:

MR (Can) 5:6

MR (US) 1:1

-

MB points can be shared among different users. You can transfer points in sets of 1,000 points. Each user can send a maximum of 100,000 points and receive up to 500,000 points in a total of 6 transactions per year. To be eligible for transferring points, your account must be open for at least 30 days with qualifying activity. If there's no qualifying activity, the account must be open for at least 90 days.

-

You have the option to buy MB points, and you can purchase up to 100,000 points each year. Normally, these points are sold at a rate of 1.25 CPP USD. However, they often have promotions where you can receive bonus points, sometimes up to 60% extra. This lowers the cost per point to around 0.78 CPP USD.

-

MB award nights are priced based on a dynamic system, meaning there is no fixed chart to determine the points needed. Typically, Standard Room award nights can range from 5,000 to 120,000 points..

5th Night Free

If you have MB status or hold an eligible co-branded credit card, you can get the fifth night free when you book a stay using points. To qualify, the booking must meet the following conditions:

The reservation is made with points only (not Cash + Points)

You book a consecutive stay of at least 5 nights in a single reservation

The points required are based on the Standard Room rate, excluding any extra cost for upgrading to a Premium Room.

Cash + Points

You can use a combination of points and money to pay for your stay.

-

It is possible to transfer MB points to the following airline transfer partners. Points are transferred at a 3:1 ratio unless otherwise noted. When transferring in increments of 60,000 points, you will receive 5,000 bonus points unless otherwise noted.

AEGEAN Miles + Bonus

Aer Lingus AerClub

Aeromexico Club Premier

Air Canada Aeroplan

Air France/KLM Flying Blue

Air New Zealand AirPoint*

Alaska Airlines Mileage Plan

American Airlines AAdvantage^

ANA Mileage Club

Asiana Airlines Asiana Club

Avianca LifeMiles^

British Airways Executive Club

Cathay Pacific Asia Miles

Copa Airlines ConnectMiles

Delta SkyMiles^

Emirates Skywards

Etihad Guest

FRONTIER Miles

Hainan Airlines Fortune Wings Club

Hawaiian Airlines HawaiianMiles

Iberia Plus

Japan Airlines JAL Mileage Bank

Jet Airways InterMiles

Korean Air SKYPASS^

LATAM Airlines LATAM Pass

Multiplus Fidelidade LATAM Pass

Qantas Frequent Flyer

Qatar Airways Privilege Club

Saudia Alfursan

Singapore Airlines KrisFlyer

Southwest Rapid Rewards

TAP Air Portugal Miles&Go

Thai Airways Royal Orchard Plus

Turkish Airlines Miles&Smiles

United MileagePlus†

Virgin Atlantic Flying Club

Virgin Australia Velocity Frequent Flyer

Vueling Club

* 200:1 transfer ratio

^ 5,000 bonus miles does not apply

† 10,000 bonus miles when transferring 60,000 points

For more information and complete details, please refer to the official page.

-

MB points will expire if there is no activity in your account for 24 consecutive months. To keep your points active, you can engage in various qualifying activities such as:

Completed paid stays at Marriott properties.

Redeeming MB points for stays at Marriott hotels.

Earning MB points through co-branded credit cards linked to the program.

Purchasing MB points directly.

-

Certain co-branded cards provide complimentary free night certificates that can be used for hotel stays. These certificates have specific point limits for redemption. In addition, if the value of the stay exceeds the certificate's value, you have the option to add up to 15,000 points to cover the remaining cost. It's important to note that these certificates must be used within 12 months from the date they are issued.

The following card offers free night rewards up to 20,000 points after spending $25,000 USD (calendar year):

Chase Marriott Bonvoy Card (US)*¤

The following card offers anniversary free night rewards up to 25,000 points (membership year):

Chase Marriott Bonvoy Premier Card (US)*^

The following cards offer anniversary free night rewards up to 35,000 points (membership year):

Marriott Bonvoy American Express Card (Can)§

Marriott Bonvoy Business American Express Card (Can)§

Marriott Bonvoy Business American Express Card (US)†

Additional free night reward after spending $60,000 USD (calendar year)§:

Marriott Bonvoy American Express Card (US)*†

Chase Marriott Bonvoy Boundless Card (US)^

Starwood Preferred Guest American Express Card (US)*

Chase Marriott Bonvoy Premier Plus Business Card (US)*^

Additional free night reward after spending $60,000 USD (calendar year)¤

The following cards offer free night rewards up to 50,000 after spending $15,000 USD (calendar year):

Marriott Bonvoy Bevy American Express Card (US)‡

Chase Marriott Bonvoy Bountiful Card (US)¤

The following cards offer anniversary free night rewards up to 85,000 points (membership year):

Marriott Bonvoy Brilliant American Express Card (US)†

Choice Award (optional free night reward up to 85,000 points) after spending $60,000 USD (calendar year)‡

Chase The Ritz-Carlton Card (US)*^

* Card not available for new applications

^ Free night certificate awarded up to 8 weeks after annual reset date

¤ Free night certificate awarded up to 12 weeks after meeting purchase requirement

§ Free night certificate awarded 8-10 weeks after annual reset date

† Free night certificate awarded 8-12 weeks after annual reset date

‡ Free night certificate awarded 8-12 weeks after meeting purchase requirement/selecting benefit

The above links point directly to the issuer of the card, American Express National Bank, Chase Bank, N. A., and Amex Bank of Canada where you can confirm card details.

They are not affiliate or referral links. Prior to submitting your application, consider using a referral from r/churningcanada's monthly referral thread to help someone in the community.